What Technology Disruptions in the Rent-A-Car Industry Mean for Your Hospitality Business?

Something digital this way comes. It sees you when you’re sleeping. It knows when you’re awake. So be ahead of the curve, for goodness sake!

By 2022, the worldwide car rental industry will be worth over $124.56 billion dollars, growing at a rate of 13.55% from 2017.

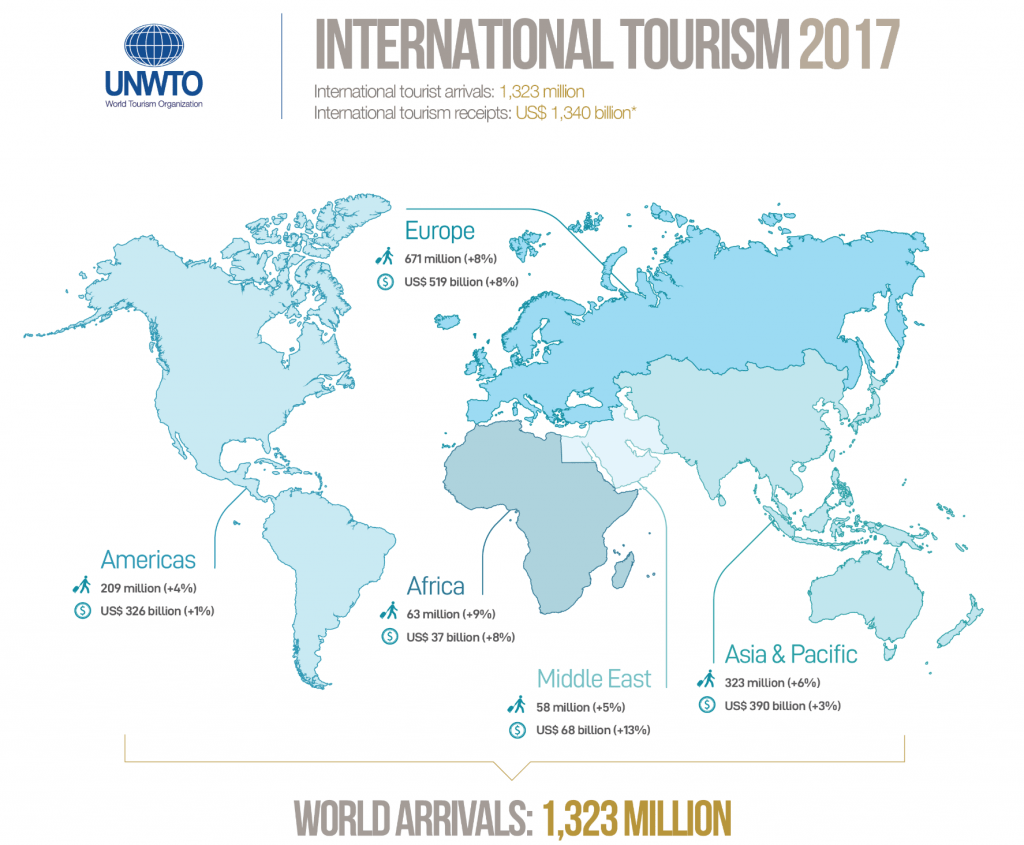

One of the fastest-growing markets for car rentals around the world so far is turning out to be Europe. It’s an industry that is intricately (and increasingly) tied to the growth of the travel and tourism industry.

So when it comes to the car rental sector, technology is promising to leave no stone unturned as it blows its way through the hospitality industry.

See, there’s a similar digital revolution going on in travel, tourism, and hospitality.

Hotels are already being equipped with mobile check-in solutions. Rooms are undergoing a digital makeover with the use of automated control systems for heating, cooling, app-driven room service, and digital assistants.

The rent-a-car market is facing just such a tech turn in the tides in two waves:

- First off, rental companies themselves are changing the value prop facing a customer by changing the way bookings are done in tandem with travel.

- Secondly, units of cars are being technologically transformed with the digital features necessary to deliver on these brand promises within the driving and on-road experience.

Let’s take a look at these specific technological disruptions and what their advance means for the hospitality industry at large.

The Tech Specs

Perhaps the greatest single change that all other “tech” changes flow from is the transformation of the car rental industry ethics. We’re moving from cars as an owned unit to “cars as a service.”

As a collective culture, it’s easy to see that disruptive apps like Uber, Lyft, and AirBnb have changed the very idea of ownership. Now, it’s all about mobility and flexibility: Cars-as-a-service (CaaS).

This change in consumption is running alongside enhancements in the car rental market itself. Fleets are changing and so are the digital features of this new and diverse collection of automobiles.

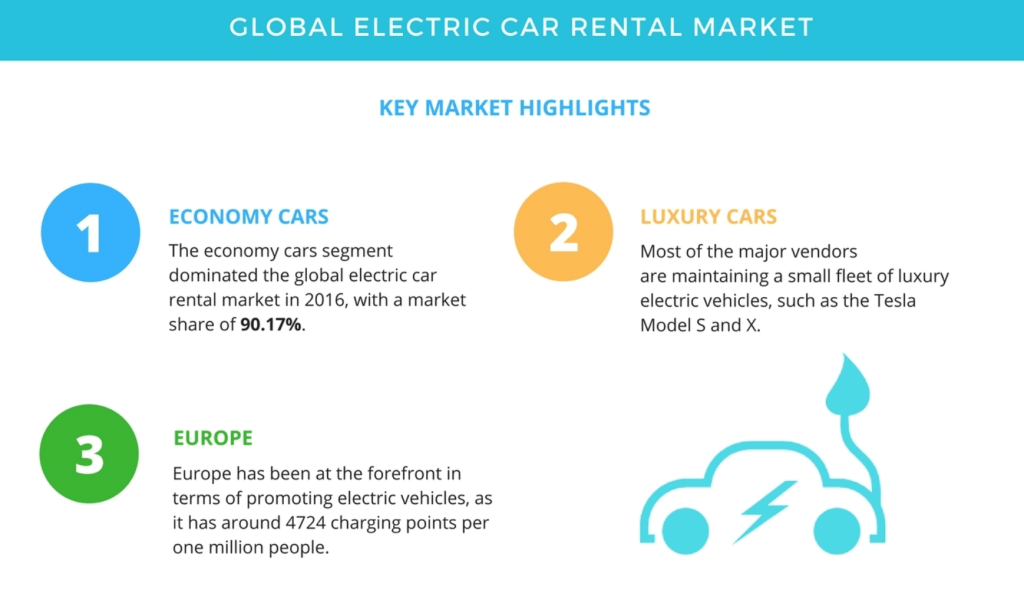

In a survey of the global electrical car rental market, economy cars are dominating the market at 90.17% of the market share, according to 2018 results.

Furthermore, luxury vendors are happily maintaining a fleet of electric vehicles such as the Tesla Model S and X.

There’s a clear demand.

Car rental as a service itself is becoming a more viable option even when travelers remain at home because there’s an emphasis on short-term rentals, pay-as-you-go models and subscription-based payments.

Online rent-a-car search and booking engines

First and foremost, search behavior is changing the way that rent-a-car brands are being found — but, also, it’s allowing the data to drive their own “findability.”

Rent-a-car search is now usually seamlessly integrated into travel and tourism bookings, or hospitality reservations.

In other words, when users search for car rentals online, booking engines will offer highly targeted and specific offers on hotel suites, tours in the location of booking, and other travel-related discounts and promotions to not only incentivize a further purchase but to create an entire experience of travel.

Known as “in-destination experiences,” this is what’s really at the heart of this rent-a-car transformation.

“Companies across all industries are trying to create a better experience for their customers,” says Jayesh Patel, a senior vice president marketing at a major car rental brand company. “We are no different.”

Digital car sharing platforms

Another major driver of tech-inspired transformation within the rent-a-car industry is the unmistakable effect of the “ride-hailing economy.”

It’s not only that the nature of the buyer is changing — from baby boomers to millennials voting with their pocketbooks to keep large, expensive, and often financially imprudent purchases off the bucket list.

It’s also that peer-to-peer car sharing and ride-hailing has opened up the gateway to cars on demand.

Apps offering reservations from a ready-to-go fleet offer individuals who travel around the world as a lifestyle the opportunity to experience that mobility and flexibility on a dime, and on their own time.

“Consumers today have access to more information whenever and wherever they need it; they have a more urban lifestyle and have new attitudes and preferences about accessing automobiles and mobility in general…There is a solid consensus that cars provide an unmatched level of convenience and freedom, allowing people to be in total control of the time, destination and environment – and that is where opportunity exists. We’re not just renting cars … we are providing mobility, and mobility keeps the world moving.”

— Pat Farrell,

Chief Marketing & Communications Officer for Enterprise Holdings

In-car mobile hot spots and digital assistants

Alexa, entertain my kids while I keep my eyes on the road.

Okay, that’s not a real command but in-car mobile hot spots enhance the experience of a road trip by offering functionality that is very familiar to the user.

In a way, it fulfills the customers’ expectations and also surpasses it because Wi-Fi is usually a “land”-based feature. How do cars keep connected if they’re not on the “wired” part of Wi-Fi?

They do so in the same way as cellphones and mobile devices, which run on a network.

While passengers — notably children — can take advantage of mobile hot spots in a rental car to keep them occupied, drivers of this new digital ridesharing market can safely and accurately deliver customers to their preferred locations, using routes that are updated in real time.

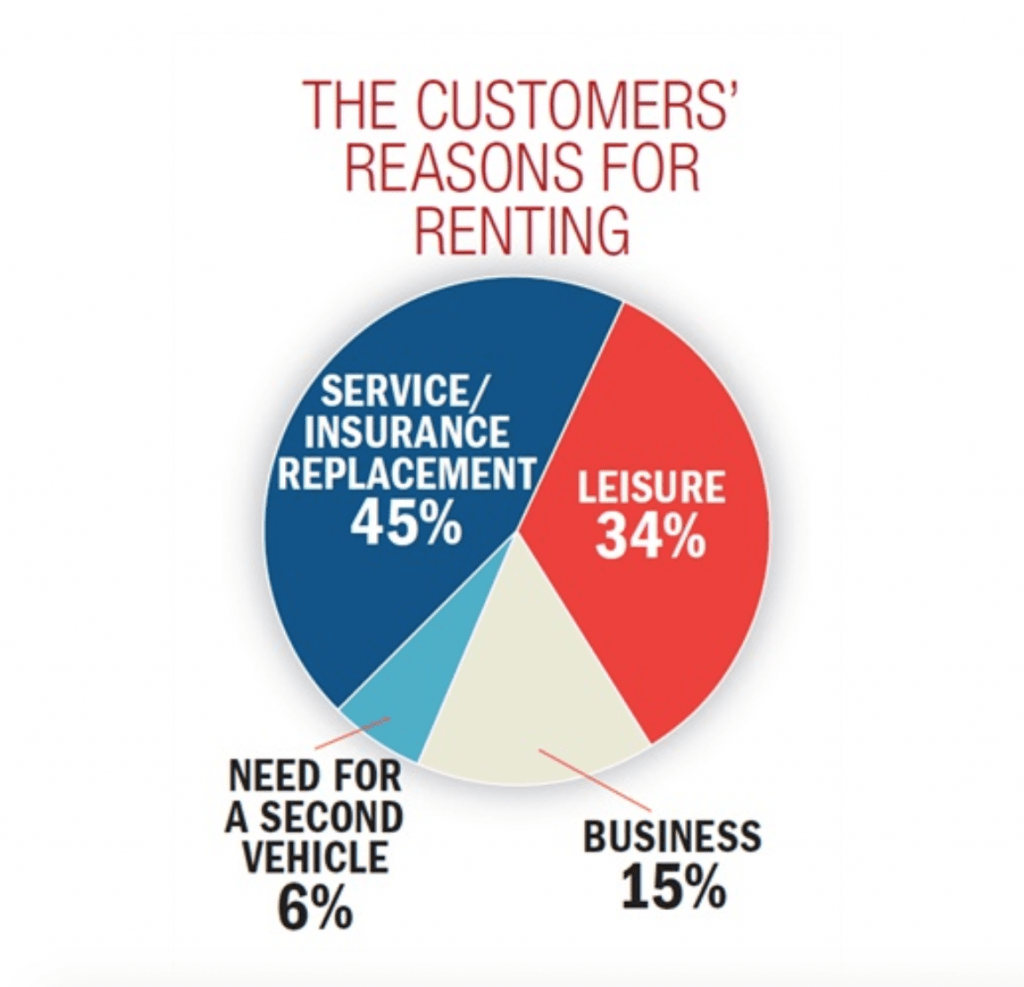

And it’s not just that. When individuals travel, 15% of them do so for business purposes. This means that in-car mobile hot spots offer businesspeople the chance to conduct their tasks on the go.

Anti-theft satellite systems

Car rentals also want to ensure that part of their customers’ experience is one of trust and safety.

That’s why one of the major “services” offered in this new CaaS economy is an anti-theft satellite system.

Here, the key is integration. Devices like SPOT Trace or Cellutrack take advantage of a device that’s in the hands of billions of users already — mobile phones — to provide added levels of safety, tracking, and security.

It puts the control back into the hands of the driver or user.

Designing a Driver’s “User Experience”

See, the user experience isn’t necessarily about inventing new technology.

You’ll notice that many of these so-called “transformations” are simply changes in how things are already being done, relying on a level of assumed consumer adoption (namely, of mobile devices) to run new and innovative software on.

So rent-a-car companies don’t have to reinvent the wheel.

Which makes sense, given that related industries like travel and hospitality don’t have to either. In order to upgrade their users’ experience and set a new standard, they simply need to find and implement digital “mirrors” for common expectations like check-ins and room service.

The actual software itself is running via mobile or digital assistant consoles like the Echo Dot.

But what is it that users want? Why are they even looking to book a hotel room or, in this case, rent a car?

To enhance the user experience, car rental companies must first understand their customers’ reasons for renting. According to a survey of 850,000 travelers in 2017, these were the results of why individual travelers relied on rental cars.

This is a win-win situation. If car rentals are being used as a service or insurance replacement, new features that enhance user experience make it more likely that they will look for similar features when they rent cars for leisure travel.

So far, we’ve seen that updates to behavior equal updates to technology. And updates to technologies call for an update in fleets themselves.

Says Susan Lombardo, senior vice-president of vehicle acquisition at Enterprise Holdings:

“Many drivers experience new automotive technologies for the first time in rental vehicles.”

She cites the fact that it’s, after all, the US car rental industry that first helped popularize anti-lock braking, stop-start technology, hybrid electric vehicles and more to consumers.

Car manufacturers are, themselves, offering a greater number of digitally-driven enhancements, including:

- Offering easier navigation: Navigation systems now link up to your mobile devices app history, drives, and preferences

- Enriched driver experience: Vehicle manufacturers like Mitsubishi are giving drivers the ability to connect to a centralized call center for emergency services through connected AI and voice recognition capabilities

- Easier geo-located assistance request

- Continuous connectivity

Conclusion

So what’s next for the future of rent-a-car “services” and experience-driven digital transformations of cars?

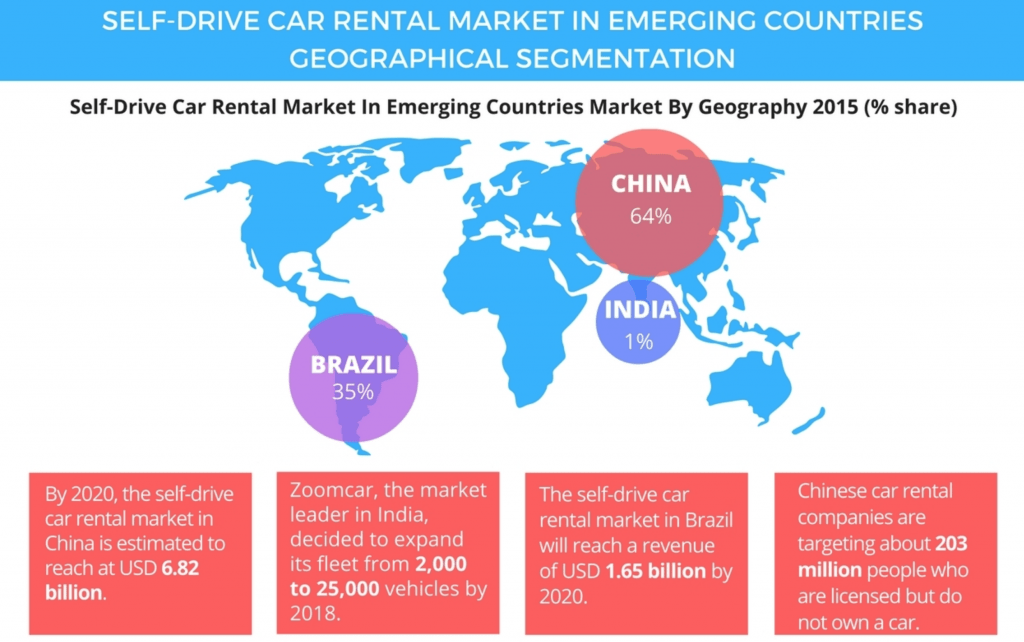

We’re seeing a greater and more rapid adoption rate of self-driving cars, especially in emerging countries, for one.

These numbers reported from 2015 alone forecast that, at a similar rate of growth, and thanks to a growing number of individuals with disposable incomes in these countries, the self-drive car rental market will reach 1.65 billion USD by 2020.

The major shift from car ownership to CaaS will develop alongside changes in conferencing technology (think about location-independent entrepreneurs running conferences during their commutes).

Insurance companies, too, are sure to be swept up in this change, offering innovative, short-term policies on rentals, making car sharing even more attractive or offering discounts on connected vehicles.

So just count on your fingers the number of services and technologies relating to commuting, road-tripping, and car rental, in general. Then watch as these utterly transform in tandem in the next five to 10 years.